NEWS

Read the related press releases to discover more about our recent activity.

8.28.2025

– PRESS RELEASE

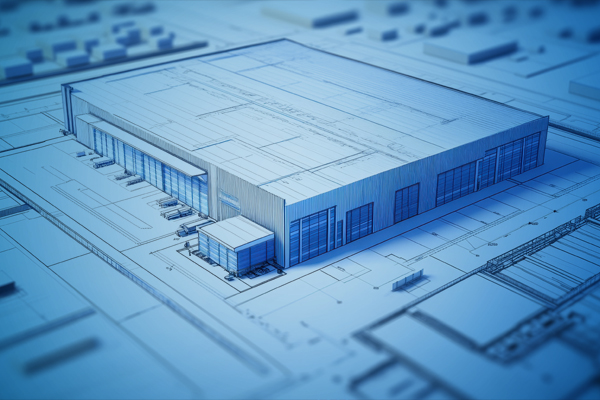

TRANSWESTERN INVESTMENT GROUP ACQUIRES 300K SF CLASS A INDUSTRIAL ASSET IN TAMPA

(AUGUST 28, 2025 – TAMPA) – Transwestern Investment Group (TIG®) announces the acquisition of Mango I-4 Logistics, a 302,940-square-foot state-of-the-art industrial facility located in Tampa, Florida. “This opportunity is consistent with Transwestern’s strategy of acquiring modern industrial facilities in supply-constrained locations with strong tenant demand,” said Chris Sterling, Director of Acquisitions for TIG. “Mango I-4 Logistics offers the high-quality design, tenant mix, and location fundamentals that position the property for long-term performance.”

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 300K SF CLASS A INDUSTRIAL ASSET IN TAMPA

(AUGUST 28, 2025 – TAMPA) – Transwestern Investment Group (TIG®) announces the acquisition of Mango I-4 Logistics, a 302,940-square-foot state-of-the-art industrial facility located in Tampa, Florida. “This opportunity is consistent with Transwestern’s strategy of acquiring modern industrial facilities in supply-constrained locations with strong tenant demand,” said Chris Sterling, Director of Acquisitions for TIG. “Mango I-4 Logistics offers the high-quality design, tenant mix, and location fundamentals that position the property for long-term performance.”

READ MORE

8.11.2025

– PRESS RELEASE

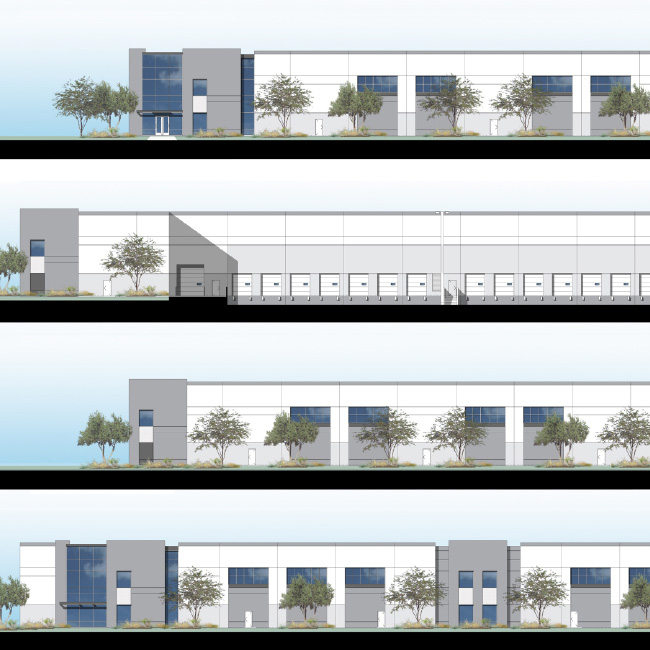

HANOVER COMPANY BEGINS CONSTRUCTION ON CROSS-DOCK WAREHOUSE IN HOUSTON, TEXAS

(August 11, 2025 – Houston) Hanover Company, alongside Transwestern Investment Group (TIG®), is excited to announce the ground-breaking of Kirby 288, a single 213,425-square-foot speculative cross-dock warehouse in Houston, Texas. The project is situated on the city’s south side, west of SH 288 and at the northwest corner of Kirby and Mowry. The facility will feature a flexible building layout, excess trailer storage, and convenient access to major transportation infrastructure.

READ MORE

HANOVER COMPANY BEGINS CONSTRUCTION ON CROSS-DOCK WAREHOUSE IN HOUSTON, TEXAS

(August 11, 2025 – Houston) Hanover Company, alongside Transwestern Investment Group (TIG®), is excited to announce the ground-breaking of Kirby 288, a single 213,425-square-foot speculative cross-dock warehouse in Houston, Texas. The project is situated on the city’s south side, west of SH 288 and at the northwest corner of Kirby and Mowry. The facility will feature a flexible building layout, excess trailer storage, and convenient access to major transportation infrastructure.

READ MORE

6.26.2025

– PRESS RELEASE

TRANSWESTERN WELCOMES DEKE SCHULTZE

(JUNE 26, 2025 – DALLAS) Transwestern announces Deke Schultze has joined Transwestern Investment Group (TIG®) as Senior Managing Director, Capital Formation. Schultze will play a key role in leading the firm’s capital formation strategy, while supporting business development and capital raising efforts across the enterprise, which includes TIG, Transwestern Development Company (TDC), Transwestern Commercial Services (TCS), and Transwestern Hospitality Group (THG).

READ MORE

TRANSWESTERN WELCOMES DEKE SCHULTZE

(JUNE 26, 2025 – DALLAS) Transwestern announces Deke Schultze has joined Transwestern Investment Group (TIG®) as Senior Managing Director, Capital Formation. Schultze will play a key role in leading the firm’s capital formation strategy, while supporting business development and capital raising efforts across the enterprise, which includes TIG, Transwestern Development Company (TDC), Transwestern Commercial Services (TCS), and Transwestern Hospitality Group (THG).

READ MORE

4.1.2025

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES COPPER POINT MEDICAL PROPERTY IN GILBERT, ARIZONA

(APRIL 1, 2025 – PHOENIX) –Transwestern Investment Group (TIG®) and its joint venture operating partner, RX Health & Science Trust (RXHST), announce the acquisition of Copper Point, a 93,262-square-foot medical outpatient facility located at 3530 South Val Vista Drive in Gilbert, Arizona. RXHST will continue to manage the asset through final lease-up and stabilization.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES COPPER POINT MEDICAL PROPERTY IN GILBERT, ARIZONA

(APRIL 1, 2025 – PHOENIX) –Transwestern Investment Group (TIG®) and its joint venture operating partner, RX Health & Science Trust (RXHST), announce the acquisition of Copper Point, a 93,262-square-foot medical outpatient facility located at 3530 South Val Vista Drive in Gilbert, Arizona. RXHST will continue to manage the asset through final lease-up and stabilization.

READ MORE

3.12.2025

– PRESS RELEASE

TRANSWESTERN APPOINTS HANS NORDBY AS EXECUTIVE MANAGING DIRECTOR OF RESEARCH

Industry Veteran to Advance Data-Driven Strategies Across Organization (MAR. 12, 2025 – HOUSTON) – Transwestern, a privately held and fully integrated commercial real estate platform spanning real estate services, investment management, development, and hospitality, announces the appointment of Hans Nordby as Executive Managing Director of Research. In this position, Nordby will lead national research initiatives, leveraging the firm’s robust data and analytics capabilities to develop compelling narratives that drive thought leadership efforts and support insights shared with Transwestern investors and clients.

READ MORE

TRANSWESTERN APPOINTS HANS NORDBY AS EXECUTIVE MANAGING DIRECTOR OF RESEARCH

Industry Veteran to Advance Data-Driven Strategies Across Organization (MAR. 12, 2025 – HOUSTON) – Transwestern, a privately held and fully integrated commercial real estate platform spanning real estate services, investment management, development, and hospitality, announces the appointment of Hans Nordby as Executive Managing Director of Research. In this position, Nordby will lead national research initiatives, leveraging the firm’s robust data and analytics capabilities to develop compelling narratives that drive thought leadership efforts and support insights shared with Transwestern investors and clients.

READ MORE

12.3.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 283-UNIT MULTIFAMILY COMMUNITY IN CHARLESTON, SC

(DECEMBER 3, 2024 – DALLAS) – Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces the sale of Daniel Island Village, a 283-unit, Class A apartment community located at 455 Seven Farms Drive in Charleston, South Carolina. The property spans 16.4 acres in the highly sought-after, master-planned community of Daniel Island.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 283-UNIT MULTIFAMILY COMMUNITY IN CHARLESTON, SC

(DECEMBER 3, 2024 – DALLAS) – Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces the sale of Daniel Island Village, a 283-unit, Class A apartment community located at 455 Seven Farms Drive in Charleston, South Carolina. The property spans 16.4 acres in the highly sought-after, master-planned community of Daniel Island.

READ MORE

7.16.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES FULLY LEASED INDUSTRIAL FACILITY IN ARLINGTON, TEXAS

(JULY 16, 2024 – DALLAS) – Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it acquired a 401,115-square-foot Class A industrial facility located in Arlington, Texas. The building is fully leased to two nationally recognized companies in the packaging and supply chain solutions sectors.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES FULLY LEASED INDUSTRIAL FACILITY IN ARLINGTON, TEXAS

(JULY 16, 2024 – DALLAS) – Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it acquired a 401,115-square-foot Class A industrial facility located in Arlington, Texas. The building is fully leased to two nationally recognized companies in the packaging and supply chain solutions sectors.

READ MORE

6.26.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES HEARTLAND AIRPORT INDUSTRIAL PORTFOLIO

(JUNE 26, 2024 – DALLAS) Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces the acquisition of the Heartland Airport Portfolio. The portfolio consists of four state-of-the-art bulk warehouse buildings totaling 792,558 square feet across the Louisville and Cincinnati Airport submarkets, two of the most desirable and high-performing industrial corridors in the Midwest.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES HEARTLAND AIRPORT INDUSTRIAL PORTFOLIO

(JUNE 26, 2024 – DALLAS) Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces the acquisition of the Heartland Airport Portfolio. The portfolio consists of four state-of-the-art bulk warehouse buildings totaling 792,558 square feet across the Louisville and Cincinnati Airport submarkets, two of the most desirable and high-performing industrial corridors in the Midwest.

READ MORE

6.1.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP TO DELIVER NEW CLASS A INDUSTRIAL PARK IN HOUSTON

(JUNE 1, 2024 – HOUSTON) Transwestern Investment Group (TIG®), on behalf of a separately managed account, is developing Innerbelt Northwest Logistics, a two-building, Class A industrial park totaling 601,680 square feet on Fairbanks North Houston Road in Houston’s Northwest submarket. Delivery is expected in the second quarter of 2025.

READ MORE

TRANSWESTERN INVESTMENT GROUP TO DELIVER NEW CLASS A INDUSTRIAL PARK IN HOUSTON

(JUNE 1, 2024 – HOUSTON) Transwestern Investment Group (TIG®), on behalf of a separately managed account, is developing Innerbelt Northwest Logistics, a two-building, Class A industrial park totaling 601,680 square feet on Fairbanks North Houston Road in Houston’s Northwest submarket. Delivery is expected in the second quarter of 2025.

READ MORE

5.15.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS I-10 COMMERCE CENTER IN FONTANA, CALIFORNIA

(MAY 15, 2024 – LOS ANGELES, CALIF.) – Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces the sale of I-10 Commerce Center, a two-building, 247,647-square-foot shallow-bay industrial project in Fontana, California. The buildings were sold in two separate transactions following a full lease-up.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS I-10 COMMERCE CENTER IN FONTANA, CALIFORNIA

(MAY 15, 2024 – LOS ANGELES, CALIF.) – Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces the sale of I-10 Commerce Center, a two-building, 247,647-square-foot shallow-bay industrial project in Fontana, California. The buildings were sold in two separate transactions following a full lease-up.

READ MORE

3.1.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 601,000-SF INDUSTRIAL PROPERTY IN HOUSTON

(MAR 1, 2024 – HOUSTON) – Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 10433 Ella Blvd. in Houston. The 601,426-square-foot industrial distribution facility is fully leased to Emser Tile.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 601,000-SF INDUSTRIAL PROPERTY IN HOUSTON

(MAR 1, 2024 – HOUSTON) – Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 10433 Ella Blvd. in Houston. The 601,426-square-foot industrial distribution facility is fully leased to Emser Tile.

READ MORE

2.7.2024

– PRESS RELEASE

BRIAN DELGADO JOINS TRANSWESTERN AS GLOBAL HEAD OF CAPITAL MARKETS

(FEB. 7, 2024 – HOUSTON) – Transwestern announces Brian Delgado has been named Senior Managing Director, Global Head of Capital Markets. In this role, Delgado will partner with Charles Hazen, President of Transwestern Investment Group (TIG®), and Carleton Riser, President of Transwestern Development Company (TDC®) to lead business development and capital raising efforts for the Transwestern companies.

READ MORE

BRIAN DELGADO JOINS TRANSWESTERN AS GLOBAL HEAD OF CAPITAL MARKETS

(FEB. 7, 2024 – HOUSTON) – Transwestern announces Brian Delgado has been named Senior Managing Director, Global Head of Capital Markets. In this role, Delgado will partner with Charles Hazen, President of Transwestern Investment Group (TIG®), and Carleton Riser, President of Transwestern Development Company (TDC®) to lead business development and capital raising efforts for the Transwestern companies.

READ MORE

1.24.2024

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 607,000 SF INDUSTRIAL PROPERTY IN GREER, SC

(JAN. 24, 2024 – CHARLOTTE, S.C.) – Transwestern Investment Group (TIG®) announces it has acquired Inland Port Greer 85 Building 3 on behalf of a separately managed account. The newly built,, 607,160-square-foot industrial asset located in Greer, South Carolina, is 100% occupied and equally divided between two tenants.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 607,000 SF INDUSTRIAL PROPERTY IN GREER, SC

(JAN. 24, 2024 – CHARLOTTE, S.C.) – Transwestern Investment Group (TIG®) announces it has acquired Inland Port Greer 85 Building 3 on behalf of a separately managed account. The newly built,, 607,160-square-foot industrial asset located in Greer, South Carolina, is 100% occupied and equally divided between two tenants.

READ MORE

12.22.2023

– PRESS RELEASE

TIG AND ACENTO REAL ESTATE PARTNERS SELL INFILL INDUSTRIAL PROPERTY IN COLUMBUS, OHIO

Transwestern Investment Group (TIG®) and Washington, D.C.-based Acento Real Estate Partners announce the sale of Northwest Corporate Plaza, a 221,736-square-foot light industrial portfolio located at 4081-4119 Leap Road in Hilliard, Ohio. The two-building asset is 88.3% leased to seven tenants representing a diverse mix of industries.

READ MORE

TIG AND ACENTO REAL ESTATE PARTNERS SELL INFILL INDUSTRIAL PROPERTY IN COLUMBUS, OHIO

Transwestern Investment Group (TIG®) and Washington, D.C.-based Acento Real Estate Partners announce the sale of Northwest Corporate Plaza, a 221,736-square-foot light industrial portfolio located at 4081-4119 Leap Road in Hilliard, Ohio. The two-building asset is 88.3% leased to seven tenants representing a diverse mix of industries.

READ MORE

12.20.2023

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP AND FIDELIS INDUSTRIAL BRINGING 521,000 SF PROJECT TO AUSTIN

Transwestern Investment Group (TIG®), on behalf of a separately managed account, and Fidelis Industrial have acquired 56 acres in Georgetown, Texas, for the development of Berry Creek Business Park, a 520,571-square-foot industrial project. The three-building asset is scheduled to deliver in the fourth quarter of 2024.

READ MORE

TRANSWESTERN INVESTMENT GROUP AND FIDELIS INDUSTRIAL BRINGING 521,000 SF PROJECT TO AUSTIN

Transwestern Investment Group (TIG®), on behalf of a separately managed account, and Fidelis Industrial have acquired 56 acres in Georgetown, Texas, for the development of Berry Creek Business Park, a 520,571-square-foot industrial project. The three-building asset is scheduled to deliver in the fourth quarter of 2024.

READ MORE

11.08.2023

– PRESS RELEASE

TRANSWESTERN PARTNERS WITH ALTUS POWER TO EXPLORE DECARBONIZATION OPPORTUNITIES

Transwestern Investment Group (TIG®) and Altus Power, the leading commercial-scale provider of clean electric power, today announced an exclusive strategic partnership to explore the development and construction of solar arrays and battery storage solutions for a subset of TIG’s industrial real estate properties, furthering Transwestern’s commitment to its stated ESG objectives

READ MORE

TRANSWESTERN PARTNERS WITH ALTUS POWER TO EXPLORE DECARBONIZATION OPPORTUNITIES

Transwestern Investment Group (TIG®) and Altus Power, the leading commercial-scale provider of clean electric power, today announced an exclusive strategic partnership to explore the development and construction of solar arrays and battery storage solutions for a subset of TIG’s industrial real estate properties, furthering Transwestern’s commitment to its stated ESG objectives

READ MORE

11.02.2023

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS MIXED-USE DEVELOPMENT IN RICHARDSON, TEXAS

Transwestern Investment Group (TIG®), announces the sale of a mixed-use portfolio including four office buildings, retail, and medical office located within the CityLine development in Richardson, Texas. The assets are 97% occupied and were sold on behalf of undisclosed clients for which TIG provides asset management services.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS MIXED-USE DEVELOPMENT IN RICHARDSON, TEXAS

Transwestern Investment Group (TIG®), announces the sale of a mixed-use portfolio including four office buildings, retail, and medical office located within the CityLine development in Richardson, Texas. The assets are 97% occupied and were sold on behalf of undisclosed clients for which TIG provides asset management services.

READ MORE

09.14.2023

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 470,000-SF INDUSTRIAL PROPERTY IN HAZLETON, PA

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 101 Commerce Drive in Hazelton, Pennsylvania. The 470,000-square-foot industrial distribution facility is fully leased to an undisclosed tenant.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 470,000-SF INDUSTRIAL PROPERTY IN HAZLETON, PA

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 101 Commerce Drive in Hazelton, Pennsylvania. The 470,000-square-foot industrial distribution facility is fully leased to an undisclosed tenant.

READ MORE

09.12.2023

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 336-UNIT MULTIFAMILY ASSET IN ROUND ROCK, TX

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund II (“TSP Fund II”), announces the sale of The Warner, a 336-unit multifamily community at 2670 S. AW Grimes Blvd. in Round Rock, Texas. The 7-building property was 96.1% occupied and 97.5% leased at the time of the sale.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 336-UNIT MULTIFAMILY ASSET IN ROUND ROCK, TX

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund II (“TSP Fund II”), announces the sale of The Warner, a 336-unit multifamily community at 2670 S. AW Grimes Blvd. in Round Rock, Texas. The 7-building property was 96.1% occupied and 97.5% leased at the time of the sale.

READ MORE

08.30.2023

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 89,000-SF OFFICE ASSET IN FAIRFAX, VA

Transwestern Investment Group (TIG®) and Washington, D.C.-based Acento Real Estate Partners announce the sale of Gatewood Plaza, an 88,995-square-foot office asset located in Fairfax, Virginia. The property is 96% occupied, including long-term tenants Trident Systems and PE Systems.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 89,000-SF OFFICE ASSET IN FAIRFAX, VA

Transwestern Investment Group (TIG®) and Washington, D.C.-based Acento Real Estate Partners announce the sale of Gatewood Plaza, an 88,995-square-foot office asset located in Fairfax, Virginia. The property is 96% occupied, including long-term tenants Trident Systems and PE Systems.

READ MORE

08.16.2023

– PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 314,102-SF INDUSTRIAL PROPERTY IN LOUISVILLE, KY

Transwestern Investment Group (TIG®) announces it has acquired 8401 Air Commerce Drive on behalf of a separately managed account. The 314,102-square-foot industrial asset located in Louisville, Kentucky, is fully leased to Johnson Controls Inc.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 314,102-SF INDUSTRIAL PROPERTY IN LOUISVILLE, KY

Transwestern Investment Group (TIG®) announces it has acquired 8401 Air Commerce Drive on behalf of a separately managed account. The 314,102-square-foot industrial asset located in Louisville, Kentucky, is fully leased to Johnson Controls Inc.

READ MORE

05.17.2023

– PRESS RELEASE

TRANSWESTERN ACQUIRES 29-ACRE SITE FOR NEW INDUSTRIAL FACILITY IN ELLENWOOD, GA

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 29.1 acres in Ellenwood, Georgia, and is partnering with Transwestern Development Company (TDC®) to build a 265,775-square-foot distribution center on the site. Construction is scheduled to begin in the fourth quarter of 2023, with delivery anticipated in the third quarter of 2024.

READ MORE

TRANSWESTERN ACQUIRES 29-ACRE SITE FOR NEW INDUSTRIAL FACILITY IN ELLENWOOD, GA

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 29.1 acres in Ellenwood, Georgia, and is partnering with Transwestern Development Company (TDC®) to build a 265,775-square-foot distribution center on the site. Construction is scheduled to begin in the fourth quarter of 2023, with delivery anticipated in the third quarter of 2024.

READ MORE

05.04.2023

– PRESS RELEASE

TRANSWESTERN ACQUIRES 16-ACRE SITE FOR NEW INDUSTRIAL FACILITY IN RIVERSIDE, CA

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 15.88 acres in Riverside, California, and is partnering with Transwestern Development Company (TDC®) to build a 307,394-square-foot industrial property on the site. Construction is scheduled to begin in the third quarter of 2023, with delivery anticipated in the third quarter of 2024.

READ MORE

TRANSWESTERN ACQUIRES 16-ACRE SITE FOR NEW INDUSTRIAL FACILITY IN RIVERSIDE, CA

Transwestern Investment Group (TIG®), on behalf of Transwestern Strategic Partners Fund III (“TSP Fund III”), announces it has acquired 15.88 acres in Riverside, California, and is partnering with Transwestern Development Company (TDC®) to build a 307,394-square-foot industrial property on the site. Construction is scheduled to begin in the third quarter of 2023, with delivery anticipated in the third quarter of 2024.

READ MORE

04.20.2023

– PRESS RELEASE

TRANSWESTERN JOINS UNITED NATIONS-SUPPORTED PRINCIPLES FOR RESPONSIBLE INVESTMENT

Transwestern Investment Group (TIG®) announces it has become a signatory of the United Nations-supported Principles for Responsible Investment (PRI) as a part of its effort to foster sustainable investing.

READ MORE

TRANSWESTERN JOINS UNITED NATIONS-SUPPORTED PRINCIPLES FOR RESPONSIBLE INVESTMENT

Transwestern Investment Group (TIG®) announces it has become a signatory of the United Nations-supported Principles for Responsible Investment (PRI) as a part of its effort to foster sustainable investing.

READ MORE

03.23.2023 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 582,400 SF INDUSTRIAL PROPERTY IN COLUMBUS, OH

Transwestern Investment Group (TIG®) announces it has acquired Rickenbacker Global Logistics Park Rail Site 8 on behalf of a separately managed account. The 582,400-square-foot industrial asset located at 1417 Rail Southern Court in Columbus, Ohio, is fully leased to an investment-grade tenant.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 582,400 SF INDUSTRIAL PROPERTY IN COLUMBUS, OH

Transwestern Investment Group (TIG®) announces it has acquired Rickenbacker Global Logistics Park Rail Site 8 on behalf of a separately managed account. The 582,400-square-foot industrial asset located at 1417 Rail Southern Court in Columbus, Ohio, is fully leased to an investment-grade tenant.

READ MORE

02.22.2023 – PRESS RELEASE

PAUL NOLAND JOINS TRANSWESTERN AS SENIOR MANAGING DIRECTOR, HEAD OF ACQUISITIONS

Transwestern Investment Group (TIG®) announces accomplished commercial real estate investment professional Paul Noland has been named Senior Managing Director, Head of Acquisitions.

READ MORE

PAUL NOLAND JOINS TRANSWESTERN AS SENIOR MANAGING DIRECTOR, HEAD OF ACQUISITIONS

Transwestern Investment Group (TIG®) announces accomplished commercial real estate investment professional Paul Noland has been named Senior Managing Director, Head of Acquisitions.

READ MORE

01.11.2023 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES FULLY LEASED INDUSTRIAL PROPERTY IN INDIANAPOLIS, IN

Transwestern Investment Group (TIG®) announces it has acquired Ameriplex 4 on behalf of a separately managed account. The property, a 912,522-square-foot Class A industrial asset located at Ameriplex Parkway and I-70 in Indianapolis, Indiana, is fully leased by PepsiCo’s Quaker Sales & Distribution Inc.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES FULLY LEASED INDUSTRIAL PROPERTY IN INDIANAPOLIS, IN

Transwestern Investment Group (TIG®) announces it has acquired Ameriplex 4 on behalf of a separately managed account. The property, a 912,522-square-foot Class A industrial asset located at Ameriplex Parkway and I-70 in Indianapolis, Indiana, is fully leased by PepsiCo’s Quaker Sales & Distribution Inc.

READ MORE

12.07.2022 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 500,000 SF CLASS A WAREHOUSE IN ST. LOUIS MARKET

Transwestern Investment Group (TIG®) on behalf of its discretionary investment fund, Transwestern Strategic Partners Fund II (“TSP Fund II”), announces the sale of 28 Gateway Commerce Center, a 500,000-square-foot, Class A cross-dock warehouse in Edwardsville, Illinois. The property was fully leased to Walgreens.com, Inc. at the time of sale.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 500,000 SF CLASS A WAREHOUSE IN ST. LOUIS MARKET

Transwestern Investment Group (TIG®) on behalf of its discretionary investment fund, Transwestern Strategic Partners Fund II (“TSP Fund II”), announces the sale of 28 Gateway Commerce Center, a 500,000-square-foot, Class A cross-dock warehouse in Edwardsville, Illinois. The property was fully leased to Walgreens.com, Inc. at the time of sale.

READ MORE

11.15.2022 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 100% LEASED, 179,000 SF OFFICE ASSET IN REDMOND, WA

Transwestern Investment Group (TIG®) announces the sale of Redmond Hilltop, a 178,957-square-foot office asset comprising three two-story buildings in Redmond, Washington. The property is fully leased on a long-term basis to a single, undisclosed tenant.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 100% LEASED, 179,000 SF OFFICE ASSET IN REDMOND, WA

Transwestern Investment Group (TIG®) announces the sale of Redmond Hilltop, a 178,957-square-foot office asset comprising three two-story buildings in Redmond, Washington. The property is fully leased on a long-term basis to a single, undisclosed tenant.

READ MORE

10.31.2022 – PRESS RELEASE

GARY JAYE NAMED CHIEF INVESTMENT OFFICER FOR TRANSWESTERN INVESTMENT GROUP

Transwestern Investment Group (TIG®) announces it has named Gary Jaye Executive Managing Director and Chief Investment Officer. Jaye will direct overall investments for TIG, including the Transwestern Strategic Partners Fund series and various separate accounts, as well as lead a team of investment professionals who are pursuing exceptional real estate investment and development opportunities nationwide.

READ MORE

GARY JAYE NAMED CHIEF INVESTMENT OFFICER FOR TRANSWESTERN INVESTMENT GROUP

Transwestern Investment Group (TIG®) announces it has named Gary Jaye Executive Managing Director and Chief Investment Officer. Jaye will direct overall investments for TIG, including the Transwestern Strategic Partners Fund series and various separate accounts, as well as lead a team of investment professionals who are pursuing exceptional real estate investment and development opportunities nationwide.

READ MORE

10.26.2022 – PRESS RELEASE

TRANSWESTERN CLOSES THIRD U.S. DIVERSIFIED VALUE-ADD REAL ESTATE FUND

Transwestern Investment Group (TIG®), the investment management arm of the Transwestern family of companies, announces that it has raised $325 million of commitments for Transwestern Strategic Partners Fund III (“TSP Fund III”), a discretionary closed-end fund. TSP Fund III marks the firm’s largest fundraise to date.

READ MORE

TRANSWESTERN CLOSES THIRD U.S. DIVERSIFIED VALUE-ADD REAL ESTATE FUND

Transwestern Investment Group (TIG®), the investment management arm of the Transwestern family of companies, announces that it has raised $325 million of commitments for Transwestern Strategic Partners Fund III (“TSP Fund III”), a discretionary closed-end fund. TSP Fund III marks the firm’s largest fundraise to date.

READ MORE

07.19.2022 – PRESS RELEASE

TRANSWESTERN ACQUIRES 4.6 ACRE SITE IN NORTH LOS ANGELES FOR NEW INDUSTRIAL FACILITY

Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces it has acquired 4.6 acres in the Palmdale/Lancaster submarket of North Los Angeles, and is partnering with Transwestern Development Company (TDC®) to build a 99,840-square-foot industrial property on the site.

READ MORE

TRANSWESTERN ACQUIRES 4.6 ACRE SITE IN NORTH LOS ANGELES FOR NEW INDUSTRIAL FACILITY

Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces it has acquired 4.6 acres in the Palmdale/Lancaster submarket of North Los Angeles, and is partnering with Transwestern Development Company (TDC®) to build a 99,840-square-foot industrial property on the site.

READ MORE

05.31.2022 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 477,355 SF INDUSTRIAL FACILITY IN HOUSTON

Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces the sale of Southwest Commerce Center, a 477,355-square-foot cross-dock industrial facility at 611 S. Cravens Road in Missouri City, Texas. The facility was 100% leased at the time of sale.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 477,355 SF INDUSTRIAL FACILITY IN HOUSTON

Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces the sale of Southwest Commerce Center, a 477,355-square-foot cross-dock industrial facility at 611 S. Cravens Road in Missouri City, Texas. The facility was 100% leased at the time of sale.

READ MORE

03.29.2022 – PRESS RELEASE

TRANSWESTERN PROMOTES JOSH RICHARDS TO CORPORATE DIRECTOR, ESG

Transwestern, an integrated commercial real estate services, development and investment management firm, announces the promotion of Josh Richards to Corporate Director, ESG. In this role, Richards is responsible for expanding engagement across the various companies to identify, track and communicate ESG goals and key performance indicators; advocating for responsible, proactive programming that advances the brand and mission of Transwestern and its clients; evaluating partnerships and opportunities to deliver resources at the leading edge of industry; and reporting progress against the firm’s commitments to all stakeholders.

READ MORE

TRANSWESTERN PROMOTES JOSH RICHARDS TO CORPORATE DIRECTOR, ESG

Transwestern, an integrated commercial real estate services, development and investment management firm, announces the promotion of Josh Richards to Corporate Director, ESG. In this role, Richards is responsible for expanding engagement across the various companies to identify, track and communicate ESG goals and key performance indicators; advocating for responsible, proactive programming that advances the brand and mission of Transwestern and its clients; evaluating partnerships and opportunities to deliver resources at the leading edge of industry; and reporting progress against the firm’s commitments to all stakeholders.

READ MORE

03.09.2022 – PRESS RELEASE

KIMBERLY STEINBERG JOINS TRANSWESTERN INVESTMENT GROUP AS MANAGING DIRECTOR

Transwestern Investment Group (TIG®) announces Kimberly Steinberg has been named Managing Director, Head of Business Development and Investor Relations. In her role, Steinberg will oversee capital raising efforts for the firm’s fund vehicles and separately managed accounts, as well as relationship building between existing and prospective U.S. and foreign institutional investors.

READ MORE

KIMBERLY STEINBERG JOINS TRANSWESTERN INVESTMENT GROUP AS MANAGING DIRECTOR

Transwestern Investment Group (TIG®) announces Kimberly Steinberg has been named Managing Director, Head of Business Development and Investor Relations. In her role, Steinberg will oversee capital raising efforts for the firm’s fund vehicles and separately managed accounts, as well as relationship building between existing and prospective U.S. and foreign institutional investors.

READ MORE

01.25.2022 – PRESS RELEASE

TRANSWESTERN AND ACENTO SELL 213,660 SF SMALL-BAY INDUSTRIAL PORTFOLIO IN ORLANDO

Transwestern Investment Group (TIG®) and Washington, D.C.-based Acento Real Estate Partners announce the sale of a three-building, 213,660-square-foot industrial portfolio in Orlando. The properties, Monroe Commerce Center and Park South, were 100% leased at the time of sale to Florida-based Richland Capital Holdings.

READ MORE

TRANSWESTERN AND ACENTO SELL 213,660 SF SMALL-BAY INDUSTRIAL PORTFOLIO IN ORLANDO

Transwestern Investment Group (TIG®) and Washington, D.C.-based Acento Real Estate Partners announce the sale of a three-building, 213,660-square-foot industrial portfolio in Orlando. The properties, Monroe Commerce Center and Park South, were 100% leased at the time of sale to Florida-based Richland Capital Holdings.

READ MORE

11.15.2021 – PRESS RELEASE

TRANSWESTERN ACQUIRES LAND FOR 794-STALL TRAILER PARKING FACILITY IN SAN BERNARDINO, CALIFORNIA

(NOVEMBER 15, 2021 – LOS ANGELES, CALIF.) Transwestern Investment Group (TIG®), on behalf of TSP Value and Income Fund II, announces the acquisition and development of Glen Helen, a two-phase, 1,681,110-square-foot trailer storage and parking facility located at 1942 Glen Helen Road in San Bernardino, California.

READ MORE

TRANSWESTERN ACQUIRES LAND FOR 794-STALL TRAILER PARKING FACILITY IN SAN BERNARDINO, CALIFORNIA

(NOVEMBER 15, 2021 – LOS ANGELES, CALIF.) Transwestern Investment Group (TIG®), on behalf of TSP Value and Income Fund II, announces the acquisition and development of Glen Helen, a two-phase, 1,681,110-square-foot trailer storage and parking facility located at 1942 Glen Helen Road in San Bernardino, California.

READ MORE

11.12.2021 – PRESS RELEASE

NEW 285-UNIT MULTIFAMILY COMMUNITY COMING TO CHARLOTTE’S BALLANTYNE SUBMARKET

Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces it is partnering with Crescent Communities to develop a 285-unit multifamily community on a 10-acre site at 15825 Marvin Road in the city’s Ballantyne submarket. Branded NOVEL Ballantyne, construction will begin in first quarter 2022 with expected completion in the second half of 2023.

READ MORE

NEW 285-UNIT MULTIFAMILY COMMUNITY COMING TO CHARLOTTE’S BALLANTYNE SUBMARKET

Transwestern Investment Group (TIG®), on behalf of a separately managed account, announces it is partnering with Crescent Communities to develop a 285-unit multifamily community on a 10-acre site at 15825 Marvin Road in the city’s Ballantyne submarket. Branded NOVEL Ballantyne, construction will begin in first quarter 2022 with expected completion in the second half of 2023.

READ MORE

10.12.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 225,000 SF SPECULATIVE WAREHOUSE IN INLAND EMPIRE

Transwestern Investment Group (TIG®) announces the sale of I-215 Commerce Center, a 225,353-square-foot industrial building at 1648 Ashley Way in Colton, California. Situated in the popular Inland Empire East submarket, the property was 100% leased at the time of sale to an investor advised by New York-based Zurich Alternative Asset Management (ZAAM).

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 225,000 SF SPECULATIVE WAREHOUSE IN INLAND EMPIRE

Transwestern Investment Group (TIG®) announces the sale of I-215 Commerce Center, a 225,353-square-foot industrial building at 1648 Ashley Way in Colton, California. Situated in the popular Inland Empire East submarket, the property was 100% leased at the time of sale to an investor advised by New York-based Zurich Alternative Asset Management (ZAAM).

READ MORE

10.07.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP, ALLEN HARRISON SELL 208-UNIT MULTIFAMILY ASSET IN SAN ANTONIO

Transwestern Investment Group (TIG®), along with its partner, Allen Harrison, announce the sale of The Highline, a 208-unit multifamily community at 5655 UTSA Blvd. in San Antonio, Texas. The 10-building property was 98.1% occupied and 100% leased at the time of sale.

READ MORE

TRANSWESTERN INVESTMENT GROUP, ALLEN HARRISON SELL 208-UNIT MULTIFAMILY ASSET IN SAN ANTONIO

Transwestern Investment Group (TIG®), along with its partner, Allen Harrison, announce the sale of The Highline, a 208-unit multifamily community at 5655 UTSA Blvd. in San Antonio, Texas. The 10-building property was 98.1% occupied and 100% leased at the time of sale.

READ MORE

09.07.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 156,000 SF INDUSTRIAL PROPERTY IN ST. LOUIS MARKET

Transwestern Investment Group (TIG®) announces the sale of 22 Gateway Commerce Center Drive, a 155,700-square-foot industrial building in Edwardsville, Illinois, on behalf of its discretionary investment fund, TSP Value and Income Fund II. The property was 57% leased at the time of sale to New York/New Jersey-based Moxie Equities.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 156,000 SF INDUSTRIAL PROPERTY IN ST. LOUIS MARKET

Transwestern Investment Group (TIG®) announces the sale of 22 Gateway Commerce Center Drive, a 155,700-square-foot industrial building in Edwardsville, Illinois, on behalf of its discretionary investment fund, TSP Value and Income Fund II. The property was 57% leased at the time of sale to New York/New Jersey-based Moxie Equities.

READ MORE

07.22.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 2.9M SF MIDWEST INDUSTRIAL PORTFOLIO

Transwestern Investment Group (TIG®) announces the sale of a 10-building, 2.9 million-square-foot industrial portfolio on behalf of its discretionary investment fund, TSP Value and Income Fund II. The properties, which were 100% leased at the time of sale to Stockbridge, span Missouri, Indiana and Ohio.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 2.9M SF MIDWEST INDUSTRIAL PORTFOLIO

Transwestern Investment Group (TIG®) announces the sale of a 10-building, 2.9 million-square-foot industrial portfolio on behalf of its discretionary investment fund, TSP Value and Income Fund II. The properties, which were 100% leased at the time of sale to Stockbridge, span Missouri, Indiana and Ohio.

READ MORE

07.20.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 480-UNIT GARDEN-STYLE APARTMENT COMMUNITY IN PHOENIX MARKET

Transwestern Investment Group (TIG®), along with its partner, Knightvest Capital, announce the sale of Paseo Park, a 35-building garden-style apartment community at 5205 W. Thunderbird Road in Glendale, Arizona. The multifamily asset comprises 480 one-, two- and three-bedroom units and was 98.7% occupied at the time of sale to an undisclosed buyer.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 480-UNIT GARDEN-STYLE APARTMENT COMMUNITY IN PHOENIX MARKET

Transwestern Investment Group (TIG®), along with its partner, Knightvest Capital, announce the sale of Paseo Park, a 35-building garden-style apartment community at 5205 W. Thunderbird Road in Glendale, Arizona. The multifamily asset comprises 480 one-, two- and three-bedroom units and was 98.7% occupied at the time of sale to an undisclosed buyer.

READ MORE

05.26.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 138-UNIT MULTIFAMILY ASSET IN SUBURBAN CHICAGO

Transwestern Investment Group (TIG®) announces the sale of Midtown Square, a 215,000-square-foot multifamily asset at 998 Church St. in Glenview, Illinois. Located in the highly sought-after North Shore submarket, the community offers 138 one- and two-bedroom units and was 93% leased at the time of sale. READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 138-UNIT MULTIFAMILY ASSET IN SUBURBAN CHICAGO

Transwestern Investment Group (TIG®) announces the sale of Midtown Square, a 215,000-square-foot multifamily asset at 998 Church St. in Glenview, Illinois. Located in the highly sought-after North Shore submarket, the community offers 138 one- and two-bedroom units and was 93% leased at the time of sale. READ MORE

04.27.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 2 MILLION SF MICHELIN DISTRIBUTION CENTER NEAR CHICAGO

Transwestern Investment Group (TIG®) announces it has sold the Michelin Super Regional Distribution Center in Wilmington, Illinois, to Silver Creek Development.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 2 MILLION SF MICHELIN DISTRIBUTION CENTER NEAR CHICAGO

Transwestern Investment Group (TIG®) announces it has sold the Michelin Super Regional Distribution Center in Wilmington, Illinois, to Silver Creek Development.

READ MORE

03.01.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 283-UNIT APARTMENT COMMUNITY IN CHARLESTON, S.C.

Transwestern Investment Group (TIG®) announces the acquisition of Daniel Island Village, a 283-unit apartment community at 455 Seven Farms Drive in Charleston, South Carolina.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 283-UNIT APARTMENT COMMUNITY IN CHARLESTON, S.C.

Transwestern Investment Group (TIG®) announces the acquisition of Daniel Island Village, a 283-unit apartment community at 455 Seven Farms Drive in Charleston, South Carolina.

READ MORE

02.23.2021 – PRESS RELEASE

TRANSWESTERN BREAKS GROUND ON 483,500 SF OF SPECULATIVE LOGISTICS SPACE IN SOUTHERN CALIFORNIA

Transwestern Development Company (TDC®) announces it has broken ground on two speculative industrial projects in Fontana, California. Totaling 483,500 square feet, the developments are adjacent to Interstates 10 and 15, providing excellent access to the entire Southern California region.

READ MORE

TRANSWESTERN BREAKS GROUND ON 483,500 SF OF SPECULATIVE LOGISTICS SPACE IN SOUTHERN CALIFORNIA

Transwestern Development Company (TDC®) announces it has broken ground on two speculative industrial projects in Fontana, California. Totaling 483,500 square feet, the developments are adjacent to Interstates 10 and 15, providing excellent access to the entire Southern California region.

READ MORE

02.22.2021 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP PARTNERSHIP TO DEVELOP 336-UNIT MULTIFAMILY PROJECT IN AUSTIN

Transwestern Investment Group (TIG®) announces it is partnering with Stanmore Partners to develop Stanmore Warner Ranch, a 336-unit multifamily project at 2630 S. A.W. Grimes Blvd. in Round Rock, Texas.

READ MORE

TRANSWESTERN INVESTMENT GROUP PARTNERSHIP TO DEVELOP 336-UNIT MULTIFAMILY PROJECT IN AUSTIN

Transwestern Investment Group (TIG®) announces it is partnering with Stanmore Partners to develop Stanmore Warner Ranch, a 336-unit multifamily project at 2630 S. A.W. Grimes Blvd. in Round Rock, Texas.

READ MORE

12.10.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP AND TRAMMELL CROW RESIDENTIAL SELL 164-UNIT MULTIFAMILY COMMUNITY IN DENVER

Transwestern Investment Group (TIG®) and Trammell Crow Residential (TCR), the multifamily development company of Crow Holdings, announce the sale of Alexan Cherry Creek, a recently completed, 164-unit apartment community in the highly coveted Cherry Creek submarket of Denver.

READ MORE

TRANSWESTERN INVESTMENT GROUP AND TRAMMELL CROW RESIDENTIAL SELL 164-UNIT MULTIFAMILY COMMUNITY IN DENVER

Transwestern Investment Group (TIG®) and Trammell Crow Residential (TCR), the multifamily development company of Crow Holdings, announce the sale of Alexan Cherry Creek, a recently completed, 164-unit apartment community in the highly coveted Cherry Creek submarket of Denver.

READ MORE

12.03.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 338-UNIT APARTMENT COMMUNITY IN CHARLOTTE, N.C.

Transwestern Investment Group (TIG®) and a national operator announce the acquisition of Century Highland Creek, a 338-unit apartment community at 5410 Prosperity Ridge Road in Charlotte, North Carolina. Centennial Holding Co., an institutional owner based out of Atlanta, sold the property.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 338-UNIT APARTMENT COMMUNITY IN CHARLOTTE, N.C.

Transwestern Investment Group (TIG®) and a national operator announce the acquisition of Century Highland Creek, a 338-unit apartment community at 5410 Prosperity Ridge Road in Charlotte, North Carolina. Centennial Holding Co., an institutional owner based out of Atlanta, sold the property.

READ MORE

11.04.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 12.1 ACRES IN INLAND EMPIRE

(NOVEMBER 4, 2020 – LOS ANGELES, CALIF.) – Transwestern Investment Group (TIG) announces the acquisition of a 12.1-acre site in Fontana, California, for the development of two Class A shallow-bay industrial buildings totaling 247,647 square feet.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 12.1 ACRES IN INLAND EMPIRE

(NOVEMBER 4, 2020 – LOS ANGELES, CALIF.) – Transwestern Investment Group (TIG) announces the acquisition of a 12.1-acre site in Fontana, California, for the development of two Class A shallow-bay industrial buildings totaling 247,647 square feet.

READ MORE

09.14.2020 – PRESS RELEASE

TRANSWESTERN APPOINTS DOUG PRICKETT, CRE, HEAD OF INVESTMENT ANALYTICS AND RESEARCH

Transwestern announces Doug Prickett, CRE, has been named Senior Managing Director of Investments & Analytics. In this role, he will lead research efforts for the Transwestern organization, developing advanced analytics and using cutting-edge technologies to guide and support real estate investment strategy, market and asset selection, underwriting, portfolio management, and workplace solutions for Transwestern and its clients.

READ MORE

TRANSWESTERN APPOINTS DOUG PRICKETT, CRE, HEAD OF INVESTMENT ANALYTICS AND RESEARCH

Transwestern announces Doug Prickett, CRE, has been named Senior Managing Director of Investments & Analytics. In this role, he will lead research efforts for the Transwestern organization, developing advanced analytics and using cutting-edge technologies to guide and support real estate investment strategy, market and asset selection, underwriting, portfolio management, and workplace solutions for Transwestern and its clients.

READ MORE

06.01.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 238,533 SF BOHANNON LOGISTICS CENTER IN ATLANTA

Transwestern Investment Group (TIG®) announces it has acquired Bohannon Logistics Center, a 238,533-square-foot industrial building at 5002 Bohannon Road in Fairburn, Georgia. The newly constructed property was completed in early 2020.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 238,533 SF BOHANNON LOGISTICS CENTER IN ATLANTA

Transwestern Investment Group (TIG®) announces it has acquired Bohannon Logistics Center, a 238,533-square-foot industrial building at 5002 Bohannon Road in Fairburn, Georgia. The newly constructed property was completed in early 2020.

READ MORE

05.13.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES FULLY LEASED INDUSTRIAL PROPERTY IN LOS ANGELES

Transwestern Investment Group (TIG®) announces it has acquired Arenth Commerce Center. Located at 17891 – 17907 Arenth Ave. in Los Angeles, the two-building industrial property totals 90,318 square feet.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES FULLY LEASED INDUSTRIAL PROPERTY IN LOS ANGELES

Transwestern Investment Group (TIG®) announces it has acquired Arenth Commerce Center. Located at 17891 – 17907 Arenth Ave. in Los Angeles, the two-building industrial property totals 90,318 square feet.

READ MORE

01.28.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 464-UNIT COMMUNITY IN DALLAS-FORT WORTH

Transwestern Investment Group (TIG®) and S2 Capital LLC today announce the sale of The Morgan, a 464-unit multifamily community. Denver-based PaulsCorp LLC (Pauls) acquired the property at 1611 Oak Creek Lane in Bedford, Texas.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 464-UNIT COMMUNITY IN DALLAS-FORT WORTH

Transwestern Investment Group (TIG®) and S2 Capital LLC today announce the sale of The Morgan, a 464-unit multifamily community. Denver-based PaulsCorp LLC (Pauls) acquired the property at 1611 Oak Creek Lane in Bedford, Texas.

READ MORE

01.27.2020 – PRESS RELEASE

TRANSWESTERN DEVELOPMENT CO. SELLS 178,516 SF INDUSTRIAL BUILDING IN O’HARE SUBMARKET

Transwestern Development Co. (TDC®) today announces it has sold a 178,516-square-foot industrial property on behalf of TDC Franklin Park Partners I LLC, a partnership with one of Transwestern Investment Group’s (TIG®) accounts.

READ MORE

TRANSWESTERN DEVELOPMENT CO. SELLS 178,516 SF INDUSTRIAL BUILDING IN O’HARE SUBMARKET

Transwestern Development Co. (TDC®) today announces it has sold a 178,516-square-foot industrial property on behalf of TDC Franklin Park Partners I LLC, a partnership with one of Transwestern Investment Group’s (TIG®) accounts.

READ MORE

01.13.2020 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP PARTNERSHIP SELLS 519,056 SF INDUSTRIAL BUILDING IN INDIANAPOLIS

Transwestern Investment Group (TIG®) today announces it has sold a 519,056-square-foot industrial property on behalf of Acento Real Estate Partners to Founders Properties. TIG acquired this asset in 2014 as part of a 2 million-square-foot portfolio acquisition.

READ MORE

TRANSWESTERN INVESTMENT GROUP PARTNERSHIP SELLS 519,056 SF INDUSTRIAL BUILDING IN INDIANAPOLIS

Transwestern Investment Group (TIG®) today announces it has sold a 519,056-square-foot industrial property on behalf of Acento Real Estate Partners to Founders Properties. TIG acquired this asset in 2014 as part of a 2 million-square-foot portfolio acquisition.

READ MORE

11.14.2019 – Insights from Transwestern

Strength in Numbers: Homogenize Industrial Real Estate Portfolios to Maximize Returns

As many investors will attest, few industrial portfolios available today will entirely dovetail with a buyer’s needs. Real Capital Analytics data shows approximately 70% of industrial asset sales are one-off transactions, creating a fundamental mismatch between those offerings and the volume of capital that seeks large-scale placement in the sector.

READ MORE

Strength in Numbers: Homogenize Industrial Real Estate Portfolios to Maximize Returns

As many investors will attest, few industrial portfolios available today will entirely dovetail with a buyer’s needs. Real Capital Analytics data shows approximately 70% of industrial asset sales are one-off transactions, creating a fundamental mismatch between those offerings and the volume of capital that seeks large-scale placement in the sector.

READ MORE

11.12.2019 – NEWS: CNBC

Warehouse leasing plummets – because there’s so little new space to lease

(NOVEMBER 12, 2019 – HOUSTON) – Warehouse tenants soaked up about 41 million square feet of space in the third quarter of this year, a 23% drop from the previous quarter and less than half as much as a year ago, according to a new report from Transwestern.

READ MORE

Warehouse leasing plummets – because there’s so little new space to lease

(NOVEMBER 12, 2019 – HOUSTON) – Warehouse tenants soaked up about 41 million square feet of space in the third quarter of this year, a 23% drop from the previous quarter and less than half as much as a year ago, according to a new report from Transwestern.

READ MORE

06.19.2019 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP PARTNERSHIP SELLS 1.5 MILLION SF INDUSTRIAL PORTFOLIO IN INDIANAPOLIS

(JUNE 19, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has sold a 1.5 million-square-foot industrial portfolio on behalf of the Diversified International Partners Fund.

READ MORE

TRANSWESTERN INVESTMENT GROUP PARTNERSHIP SELLS 1.5 MILLION SF INDUSTRIAL PORTFOLIO IN INDIANAPOLIS

(JUNE 19, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has sold a 1.5 million-square-foot industrial portfolio on behalf of the Diversified International Partners Fund.

READ MORE

06.10.2019 – PRESS RELEASE

JIMMY HINTON TO LEAD INVESTMENT ANALYTICS AND RESEARCH FOR THE TRANSWESTERN COMPANIES

(JUNE 10, 2019 – HOUSTON) – Transwestern today announces Jimmy Hinton has been appointed Senior Managing Director of Investments & Analytics.

READ MORE

JIMMY HINTON TO LEAD INVESTMENT ANALYTICS AND RESEARCH FOR THE TRANSWESTERN COMPANIES

(JUNE 10, 2019 – HOUSTON) – Transwestern today announces Jimmy Hinton has been appointed Senior Managing Director of Investments & Analytics.

READ MORE

04.22.2019 – PRESS RELEASE

TSP VALUE AND INCOME FUND II ACQUIRES 1.5 MILLION SF INDUSTRIAL PORTFOLIO IN COLUMBUS, OHIO

(APRIL 22, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has acquired a 1.5 million-square-foot industrial portfolio on behalf of TSP Value and Income Fund II.

READ MORE

TSP VALUE AND INCOME FUND II ACQUIRES 1.5 MILLION SF INDUSTRIAL PORTFOLIO IN COLUMBUS, OHIO

(APRIL 22, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has acquired a 1.5 million-square-foot industrial portfolio on behalf of TSP Value and Income Fund II.

READ MORE

04.18.2019 – PRESS RELEASE

TSP VALUE AND INCOME FUND II RAISES $200 MILLION

(APRIL 18, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has raised $200 million for TSP Value and Income Fund II, a real estate investment fund that will follow the initial strategy of reducing volatility in the value-add space by focusing on current income while providing value creation.

READ MORE

TSP VALUE AND INCOME FUND II RAISES $200 MILLION

(APRIL 18, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has raised $200 million for TSP Value and Income Fund II, a real estate investment fund that will follow the initial strategy of reducing volatility in the value-add space by focusing on current income while providing value creation.

READ MORE

04.16.2019 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP COMPLETES MONETIZATION OF FIRST FUND

(APRIL 16, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has completed the monetization of TSP Value and Income Fund I, a real estate investment fund that delivered a 17% net IRR to investors after fees, expenses and carried interest.

READ MORE

TRANSWESTERN INVESTMENT GROUP COMPLETES MONETIZATION OF FIRST FUND

(APRIL 16, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has completed the monetization of TSP Value and Income Fund I, a real estate investment fund that delivered a 17% net IRR to investors after fees, expenses and carried interest.

READ MORE

03.22.2019 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 3.5 MILLION SF INDUSTRIAL PORTFOLIO

(MARCH 22, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has sold a 3.5 million-square-foot industrial portfolio on behalf of one of its discretionary investment funds, TSP Value and Income Fund I. An institutional foreign buyer acquired the 21 logistics facilities spanning Illinois, Ohio, Indiana and Kentucky.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 3.5 MILLION SF INDUSTRIAL PORTFOLIO

(MARCH 22, 2019 – DALLAS) – Transwestern Investment Group (TIG®) today announces it has sold a 3.5 million-square-foot industrial portfolio on behalf of one of its discretionary investment funds, TSP Value and Income Fund I. An institutional foreign buyer acquired the 21 logistics facilities spanning Illinois, Ohio, Indiana and Kentucky.

READ MORE

03.14.2019 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 400,000 SF OFFICE BUILDING IN PARSIPPANY, NEW JERSEY

(MARCH 14, 2019 – PARSIPPANY, N.J.) – Transwestern Investment Group (TIG®) today announces it has sold a 400,127-square-foot, Class A office building at 300 Kimball Drive in Parsippany, New Jersey, on behalf of a large national insurance company.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 400,000 SF OFFICE BUILDING IN PARSIPPANY, NEW JERSEY

(MARCH 14, 2019 – PARSIPPANY, N.J.) – Transwestern Investment Group (TIG®) today announces it has sold a 400,127-square-foot, Class A office building at 300 Kimball Drive in Parsippany, New Jersey, on behalf of a large national insurance company.

READ MORE

02.12.2019 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 1.2 MSF INDUSTRIAL ASSET IN FORT WORTH, TEXAS

(FEB. 12, 2019 – FORT WORTH, TEXAS) – Transwestern Investment Group (TIG®) today announces it has acquired a 1.2 million-square-foot industrial property in north Fort Worth, Texas. TIG acquired the property from DHL Supply Chain on behalf of one of its separately managed accounts.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 1.2 MSF INDUSTRIAL ASSET IN FORT WORTH, TEXAS

(FEB. 12, 2019 – FORT WORTH, TEXAS) – Transwestern Investment Group (TIG®) today announces it has acquired a 1.2 million-square-foot industrial property in north Fort Worth, Texas. TIG acquired the property from DHL Supply Chain on behalf of one of its separately managed accounts.

READ MORE

02.12.2019 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 350,171 SF SOUTHPARK COMMERCE CENTER V IN AUSTIN, TEXAS

(FEB. 12, 2019 – AUSTIN, TEXAS) – Transwestern Investment Group (TIG®) today announces it has it has sold Southpark Commerce Center V to Hillwood. Located within the Southeast industrial submarket of Austin, Southpark Commerce Center V is a recently completed, 50 percent leased, three-building project totaling 350,171 square feet at 4500 S. Pleasant Valley Road in Austin, Texas.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 350,171 SF SOUTHPARK COMMERCE CENTER V IN AUSTIN, TEXAS

(FEB. 12, 2019 – AUSTIN, TEXAS) – Transwestern Investment Group (TIG®) today announces it has it has sold Southpark Commerce Center V to Hillwood. Located within the Southeast industrial submarket of Austin, Southpark Commerce Center V is a recently completed, 50 percent leased, three-building project totaling 350,171 square feet at 4500 S. Pleasant Valley Road in Austin, Texas.

READ MORE

11.01.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP TO FORM STRATEGIC RELATIONSHIP WITH TEXAS MUNICIPAL RETIREMENT SYSTEM

(NOV. 1, 2018 – DALLAS) – Transwestern Investment Group (TIG®) today announces that Texas Municipal Retirement System (TMRS) has approved the formation of a strategic relationship with TIG involving a $250 million commitment to multiple real estate investments managed by TIG. The investments will include discretionary vehicles and separately managed accounts investing in core, core-plus and value-add strategies in major markets across the U.S. targeting industrial, multifamily, office, retail and healthcare.

READ MORE

TRANSWESTERN INVESTMENT GROUP TO FORM STRATEGIC RELATIONSHIP WITH TEXAS MUNICIPAL RETIREMENT SYSTEM

(NOV. 1, 2018 – DALLAS) – Transwestern Investment Group (TIG®) today announces that Texas Municipal Retirement System (TMRS) has approved the formation of a strategic relationship with TIG involving a $250 million commitment to multiple real estate investments managed by TIG. The investments will include discretionary vehicles and separately managed accounts investing in core, core-plus and value-add strategies in major markets across the U.S. targeting industrial, multifamily, office, retail and healthcare.

READ MORE

10.26.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 101,695 SF OFFICE PROPERTY ON BEHALF OF A MANAGED FUND

(OCT. 26, 2018 – REDMOND, WASH.) – Transwestern Investment Group (TIG®) today announces it has sold Redmond Technology Center on behalf of one of its managed funds. The 101,695-square-foot, Class A office building is located at 18300 Redmond Way in Redmond, Washington.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 101,695 SF OFFICE PROPERTY ON BEHALF OF A MANAGED FUND

(OCT. 26, 2018 – REDMOND, WASH.) – Transwestern Investment Group (TIG®) today announces it has sold Redmond Technology Center on behalf of one of its managed funds. The 101,695-square-foot, Class A office building is located at 18300 Redmond Way in Redmond, Washington.

READ MORE

10.04.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 300,000 SF OFFICE PARK IN SAN JOSE, CALIFORNIA

(OCT. 4, 2018 – SAN JOSE, CALIF.) – Transwestern Investment Group (TIG®) today announces it has sold Central Park Plaza on behalf of TSP Value and Income Fund I, continuing the successful value creation and subsequent monetization of TIG’s initial TSP Value and Income Fund. The 300,000-square-foot office park is located at 2833 – 2841 Junction Ave. and 2860 – 2890 Zanker Road in San Jose, California.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 300,000 SF OFFICE PARK IN SAN JOSE, CALIFORNIA

(OCT. 4, 2018 – SAN JOSE, CALIF.) – Transwestern Investment Group (TIG®) today announces it has sold Central Park Plaza on behalf of TSP Value and Income Fund I, continuing the successful value creation and subsequent monetization of TIG’s initial TSP Value and Income Fund. The 300,000-square-foot office park is located at 2833 – 2841 Junction Ave. and 2860 – 2890 Zanker Road in San Jose, California.

READ MORE

10.03.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP, VIRTUS REAL ESTATE CAPITAL ACQUIRE 114,413 SF WEST HOUSTON OFFICE ASSET

(OCT. 3, 2018 – HOUSTON) – Transwestern Investment Group (TIG®) and its partner Virtus Real Estate Capital (Virtus) today announced the acquisition of a 114,413-square-foot property at 2051 S. Greenhouse Road in West Houston. The new ownership plans to reposition the asset as a medical office building, which will be leased and managed by Transwestern.

READ MORE

TRANSWESTERN INVESTMENT GROUP, VIRTUS REAL ESTATE CAPITAL ACQUIRE 114,413 SF WEST HOUSTON OFFICE ASSET

(OCT. 3, 2018 – HOUSTON) – Transwestern Investment Group (TIG®) and its partner Virtus Real Estate Capital (Virtus) today announced the acquisition of a 114,413-square-foot property at 2051 S. Greenhouse Road in West Houston. The new ownership plans to reposition the asset as a medical office building, which will be leased and managed by Transwestern.

READ MORE

09.05.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 99,000 SF INDUSTRIAL PORTFOLIO IN AUSTIN, TEXAS

(SEPT. 5, 2018 – AUSTIN, TEXAS) – Transwestern Investment Group (TIG®) today announces it has sold Park 96 on behalf of TSP Value and Income Fund I, continuing the successful value creation and subsequent monetization of TIG’s initial TSP Value and Income Fund. The 99,000-square-foot industrial project is located at 9601 Dessau Road in Austin.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 99,000 SF INDUSTRIAL PORTFOLIO IN AUSTIN, TEXAS

(SEPT. 5, 2018 – AUSTIN, TEXAS) – Transwestern Investment Group (TIG®) today announces it has sold Park 96 on behalf of TSP Value and Income Fund I, continuing the successful value creation and subsequent monetization of TIG’s initial TSP Value and Income Fund. The 99,000-square-foot industrial project is located at 9601 Dessau Road in Austin.

READ MORE

08.09.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS FULLY LEASED, 350,012 SF TOWNPARK COMMONS IN KENNESAW, GEORGIA

(AUG. 9, 2018 – KENNESAW, GA.) – Transwestern Investment Group (TIG®) today announces it has sold TownPark Commons on behalf of one of its managed funds. The 350,012-square-foot office project is at 125 – 500 TownPark Drive in Kennesaw, Georgia.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS FULLY LEASED, 350,012 SF TOWNPARK COMMONS IN KENNESAW, GEORGIA

(AUG. 9, 2018 – KENNESAW, GA.) – Transwestern Investment Group (TIG®) today announces it has sold TownPark Commons on behalf of one of its managed funds. The 350,012-square-foot office project is at 125 – 500 TownPark Drive in Kennesaw, Georgia.

READ MORE

03.26.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 464-UNIT COMMUNITY IN DALLAS-FORT WORTH WITH S2 CAPITAL

(MARCH 26, 2018 – DALLAS) – Transwestern Investment Group (TIG®) and S2 Capital LLC today announce the acquisition of Oak Creek Apartments on behalf of one of its managed funds. Located at 1611 Oak Creek Lane in Bedford, Texas, the 464-unit property is one of the largest Class B communities in the “midcities” between Dallas and Fort Worth. Transwestern’s Managing Director Taylor Snoddy and Vice Presidents Philip Wiegand and James Roberts represented the seller in the transaction. This value-add acquisition represents the first multifamily purchase of the fund.

READ MORE

TRANSWESTERN INVESTMENT GROUP ACQUIRES 464-UNIT COMMUNITY IN DALLAS-FORT WORTH WITH S2 CAPITAL

(MARCH 26, 2018 – DALLAS) – Transwestern Investment Group (TIG®) and S2 Capital LLC today announce the acquisition of Oak Creek Apartments on behalf of one of its managed funds. Located at 1611 Oak Creek Lane in Bedford, Texas, the 464-unit property is one of the largest Class B communities in the “midcities” between Dallas and Fort Worth. Transwestern’s Managing Director Taylor Snoddy and Vice Presidents Philip Wiegand and James Roberts represented the seller in the transaction. This value-add acquisition represents the first multifamily purchase of the fund.

READ MORE

01.23.2018 – PRESS RELEASE

BLAKE WILLIAMS JOINS TRANSWESTERN TO OVERSEE INTEGRATED HEALTHCARE INVESTMENT STRATEGIES

(JAN. 23, 2018 – HOUSTON) – Transwestern Investment Group (TIG®) today announces Blake Williams has joined the firm as Managing Director – Healthcare Properties. In this role, he will lead the efforts of TIG and Transwestern Development Company (TDC®) to acquire and develop healthcare properties across the U.S., with a focus on integrating the firm’s investment and development platforms for comprehensive execution strategies.

READ MORE

BLAKE WILLIAMS JOINS TRANSWESTERN TO OVERSEE INTEGRATED HEALTHCARE INVESTMENT STRATEGIES

(JAN. 23, 2018 – HOUSTON) – Transwestern Investment Group (TIG®) today announces Blake Williams has joined the firm as Managing Director – Healthcare Properties. In this role, he will lead the efforts of TIG and Transwestern Development Company (TDC®) to acquire and develop healthcare properties across the U.S., with a focus on integrating the firm’s investment and development platforms for comprehensive execution strategies.

READ MORE

01.18.2018 – PRESS RELEASE

TRANSWESTERN INVESTMENT GROUP SELLS 226,358 SF LINCOLN TOWNE CENTRE IN SCOTTSDALE, ARIZONA

(JAN. 18, 2018 – SCOTTSDALE, ARIZ.) – Transwestern Investment Group (TIG®) today announces it has sold Lincoln Towne Centre on behalf of TSP Value and Income Fund I LP. The 226,358-square-foot office complex is at 4150 – 4250 N. Drinkwater Blvd. in Scottsdale, Arizona. Eastdil Secured represented the seller in the transaction.

READ MORE

TRANSWESTERN INVESTMENT GROUP SELLS 226,358 SF LINCOLN TOWNE CENTRE IN SCOTTSDALE, ARIZONA

(JAN. 18, 2018 – SCOTTSDALE, ARIZ.) – Transwestern Investment Group (TIG®) today announces it has sold Lincoln Towne Centre on behalf of TSP Value and Income Fund I LP. The 226,358-square-foot office complex is at 4150 – 4250 N. Drinkwater Blvd. in Scottsdale, Arizona. Eastdil Secured represented the seller in the transaction.

READ MORE